Impact of GST on E-commerce

E-commerce in India:

Market place model: An

asset light model wherein the e-commerce firm merely acts as a platform and

connects buyers and sellers and does not own any inventory. 100% FDI (Foreign

Direct Investment) is allowed.

Ex:

Amazon, Flipkart, Snapdeal, eBay etc.

Inventory based Model:

The e-commerce firm owns the inventory of goods and services and sells to the

consumers directly. No FDI allowed.

Ex:

Bigbasket, Jabong

Taxation blues:

Today

e-commerce in India is mired in a host of taxes: VAT / CST / Service Tax / TDS

with more than one tax applicable on any given transaction. Involvement of

logistics / reverse logistics, advertising & promotion services, goods like

software, music, e-books etc. makes it hard to differentiate Goods &

Services component of each transaction.

Also, grey areas have emerged due to e-commerce players who have adopted

marketplace model are having own warehouses to store the inventory. Although

there is visible value addition by e-commerce players no VAT is being paid by

them. This has resulted in many disputes with state commercial tax departments.

Karnataka has been insisting on these warehouses to be registered under VAT and

e-commerce players be considered as consignment agents and be made to pay VAT.

Several states (Ex: Delhi, Rajasthan) have insisted on separate disclosures by

dealers of online transactions due to concerns of such sales getting

under-reported. Uttar Pradesh has imposed several restrictions (declaration

form) on interstate purchase of goods worth more than Rs 5,000 through

e-commerce. States like Uttarakhand, Bihar, West Bengal, Himachal Pradesh and

Uttar Pradesh have levied entry tax ranging from 5 to 10% on goods purchased

interstate through e-commerce platforms.

E-Commerce in GST:

Many

e-commerce firms have welcomed GST since for the first time there is a legal

framework that defines ‘electronic commerce’ and

‘electronic commerce operator’. Although the draft model law is far

from being comprehensive, it is expected to evolve and attain maturity.

Business Process Impact:

Outward Supply: With

GST, uniformity in compliance across India is ensured, thus e-commerce sellers

can look for markets beyond state boundaries without the hassles associated

with complying to state specific rules (Ex: Declaration Forms, Way Bills) and

taxes (Ex: Entry Tax).

Compliance: All

sellers on e-commerce platforms will have to obtain GST registration

irrespective of turnover meaning increased compliance vis-à-vis offline

sellers. Fulfillment centre of e-commerce to be registered as additional place

of business by sellers and stock transfer will be treated as taxable supply

leading to cash flow issues. Both the vendor and e-commerce operator will have

to report supplies and will be cross-matched. Any supply reported by operator

but not by vendor will be added to the liability of the vendor.

Tax Invoice: Tax invoices need to be physically or

digitally signed (digital signature ink).

Schemes and Discounts: All

discounts will have to be explicitly mentioned in invoice and post supply

discounts by market place to a seller (promotions) will have to be more

explicit and be agreed in advance. As Freebies will also be taxable, sellers

will need to tweak their offerings.

Logistics: With

e-commerce operators expected to collect a portion of GST and pay to the

government on behalf of the seller (Tax Collected at source at 2%) there is a

new paradigm getting established. The TCS deducted on aggregate sales for the

month (sales less sales return) will be credited to electronic cash ledger of

seller. E-commerce players providing

their own logistics services will be able to quickly adopt to this new reality

as cash flow happens through their network. With nearly two third sales

happening through CoD (Cash on Delivery) model, if a third party logistics

provider is involved, the cash flows have to be now tweaked to flow back to the

e-commerce operator to enable deduction of tax. Alternatively, the tax amount of

CoD orders has to be now deducted from pre-paid sales.

With many e-commerce firms following weekly settlement for sellers, the TCS needs to be deducted in such invoices and filed by e-commerce operator in their GSTR-1.

(Note: This is not to be confused with 10% income tax TDS (on commission) which sellers are supposed to deduct while paying commission to e-commerce operator. This in practice is currently deducted by operator and paid to income tax department on behalf of seller.)

Reverse Logistics:

With high prevalence of goods returns (15-20%) and cancellations, reverse

logistics also needs to be more robust. Raising of credit note is not a very

prevalent practice currently, but will have to be adopted for accurate

depiction of tax liability.

High

volume of transactions (200 to 300 per day), thin margins, and increased

compliance (upload & matching, advance tax) mean, only adoption of a robust

IT solution can guarantee smooth business operations.

Depiction of Process Flow:

Below

diagram illustrates the flow of orders and funds in the GST era:

Fulfillment

of Cash on Delivery order by an e-commerce seller through a 3PL provider is

illustrated. In this case fulfillment is by seller and not the marketplace.

Order and Goods Flow:

Cash Flow:

Let

us assess the impact using an example as below:

M/S

SLV Traders deals in Metallic Sports Water Bottles. He purchases them directly

from manufacturer and sells on e-commerce platforms through the fulfillment

model.

Assumptions:

For the sake of this illustration, it is assumed that the products are charged

at 5% VAT, and goods charged at lower VAT rate are likely to be charged at

lower rate of GST as well (12%). For the sake of comparison the purchase and

sale price are kept same in both tax regimes.

Current Tax Regime:

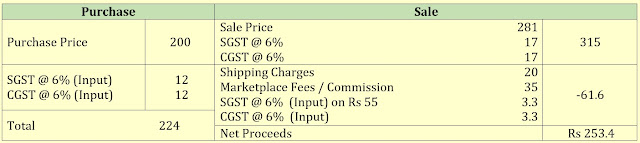

GST Regime:

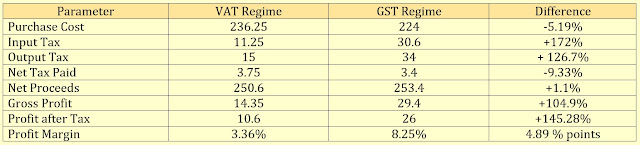

Comparison:

Findings:

·

Despite similar purchase and sale price in both VAT and GST regime, the

profitability is much higher in GST. This is mainly due to a number of taxes

(Central Excise and Service Tax) that formed costs in VAT regime will be

available as inputs in GST regime.

· In the above illustration although the GST rate at 12% is much higher

than VAT rate of 5%, the net tax payable in GST regime is lower by 9% due to

elimination of cascading effect.

· In the medium to long term due to competition the profit margin levels

may come down to pre-GST levels and thus the benefits of lower cost and lower

tax payable will be passed onto end customer.

Impact Assessment:

The

earlier draft model law talked principally of two categories of online players,

i.e market places and aggregators of services under their brand name (Ex: Ola/Uber/IRCTC/Makemytrip

etc.). However, many e-commerce players act as both aggregator and marketplace. Other

prevalent e-commerce formats like aggregators of ‘goods’ under their brand (Ex: Quikr/CarTrade/Olx etc.) are not

clearly defined. Many e-commerce firms only act as a meeting place for buyers

and sellers and are not themselves involved in financial transaction (Ex: B2B

players like Alibaba and eBay) and hence collection of tax at source cannot be

applied. A host of job portals (Ex: Naukri.com, Timesjobs), matrimonial

websites (Ex: Shaadi.com, Jeevansaathi.com), restaurant booking (Ex: Zomato),

food delivery (Ex: Swiggy), adventure/vacation booking sites (Ex:

Thrillophilia), hyperlocal delivery (Ex: Grofers, Amazon Now, Zopnow), cab

rentals (Ex: Zoomcar, Myles), digital wallets (Ex: Paytm), music download,

mobile advertising (Ex: InMobi) have innovative business models which cannot be

classified as a pure play marketplace or aggregator. Hence further redefining

of Model draft law is needed.

The

revised draft GST law however has removed the definition of aggregators and

these might get covered under draft rules.

Conclusion:

In

conclusion, the benefits of GST resulting from uniformity in processes across

the country, elimination of cascading effect, boost to economy, legal standing

for e-commerce will far outweigh the glitches pertaining to increased compliance

burden. E-commerce platforms and sellers

will have to make the necessary changes to their IT infrastructure to

accommodate for ‘destination-based-consumption’ regime and to meet new accounting requirements pertaining to Tax

deduction at source. E-commerce sellers will be required to be mandatorily

registered under GST irrespective of turnover. Outward supply reported by

sellers (GSTR-1) will be compared with report of sales by e-commerce operator

(GSTR-8) and any under reporting will be penalized adding to compliance burden.

With many e-commerce unicorns (valuation in excess of 1 Billion US $) emerging

in India (Flipkart, Ola, InMobi, Paytm, Shopclues, Zomato) GST law needs to

encourage such business growth while not compromising on reasonable tax

demands.

Wonderful post and such a fantastic information that you gave to us. Thank you so much for it. You made a good site and also you sharing the best information on this topic. I am impressed with your site’s blog. Thank you all

ReplyDeleteGSTR1 Filing

This is very knowledgeable blog post. I have get some of the best point from here and it will help me for improved my skills and business. Thank you for sharing this with us and GST Consultation.

ReplyDeleteI hope you will post more Updates.

ReplyDeleteThanks for the post

zohosetup